A payslip comprises the breakdown of the amount of pay before tax and other schemes are deducted, as well as the net salary that the employee will receive. It is a document that the employer issues to their employees at the same frequency as their salary payments, whether those are weekly, bi-monthly or monthly.

Tax filing: In case you have your changed job in the year and you are not able to trace your form 16 or not able to get it from your previous employer, you can file for your taxes using the monthly salary slips to calculate your income.Employment proof: It can also serve as your official proof of employment at certain places like in the case of travel visa or at a university where it would be required.Government agencies: In order to avail some subsidies reserved for certain income groups only, one needs to show salary slip.You will be asked to show your payslips from the past months as income proof. Shopping: While shopping at a store for the high priced item that you wish to pay in installments, you can avail the EMI facility for it.Banks: You will require to submit it as an income proof for credit card applications, taking loans, and other types of borrowings.Salary slips serve as a record of your earnings that you will need to submit at various places of business. Why is important to have a record of your salary slips? You can check if your employer has deposited the mentioned amount with the government be viewing your form 26AS on the e-fling website. It is paid by your employer on your behalf based on the taxable slab rules of the Income Tax department. TDS: Tax Deducted at Source is the share of tax that you are liable to pay to the government.The rate at which it is charged varies from state to state.

Format of salary slip professional#

So if you work in the states of Andhra Pradesh, Assam, Bihar, Chattisgarh, Gujarat, Karnataka, Kerala, Maharashtra, Madhya Pradesh, Meghalaya, Odisha, Sikkim, Tamil Nadu, Telangana, Tripura or West Bengal, a part of your salary is paid as professional tax.

Format of salary slip plus#

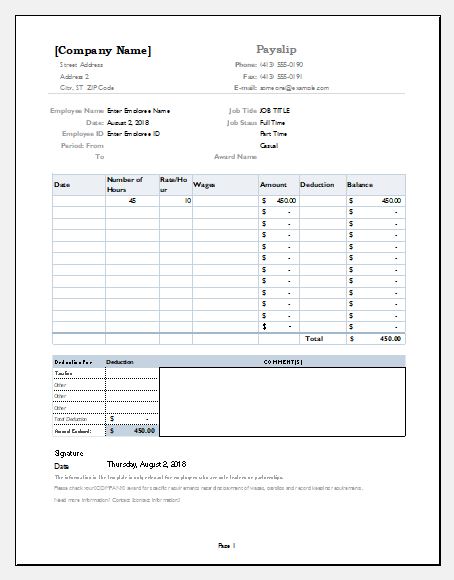

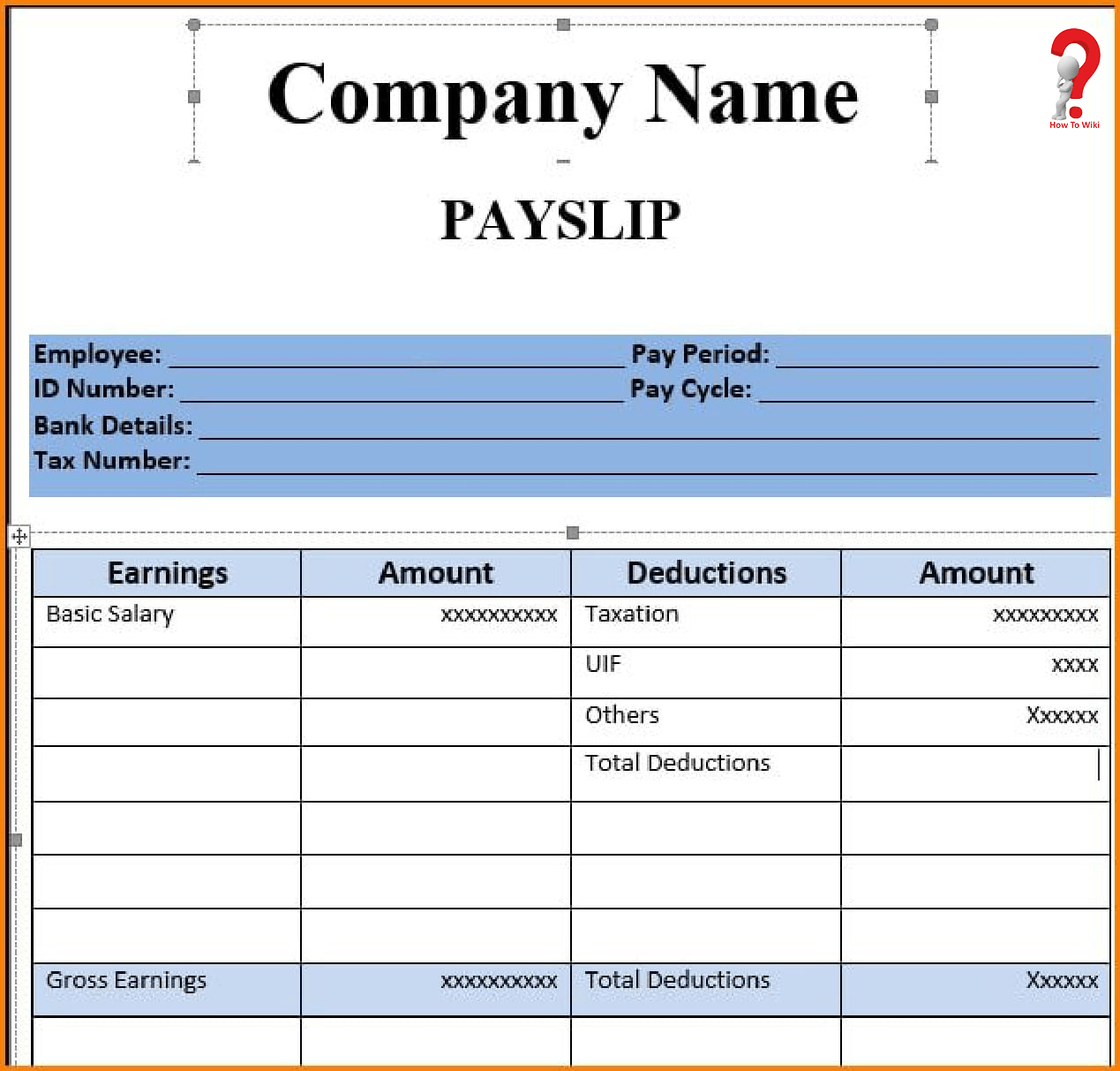

In case you receive DA, your PF will be calculated as a percentage (that is 12 percent) of the basic pay plus DA. Dearness Allowance: Received mostly by government employees, it is an allowance paid to reduce the impact of inflation on the employee.It usually makes up for 35 to 40 percent of your total pay. This is because it decides most of the other contents of your pay like EPF (Employee Provident Fund) share made towards your retirement fund. Basic salary: This is the most important of all the other details.The main components of a salary slip include earnings and a deductions section.

0 kommentar(er)

0 kommentar(er)